TRX Price Prediction: Technical Strength and Regulatory Tailwinds Signal Investment Opportunity

#TRX

- TRX trading above 20-day MA indicates near-term bullish momentum

- Regulatory developments and Nasdaq ambitions provide fundamental support

- Bollinger Band positioning suggests potential for upward movement with defined support/resistance levels

TRX Price Prediction

Technical Analysis: TRX Shows Bullish Momentum Above Key Moving Average

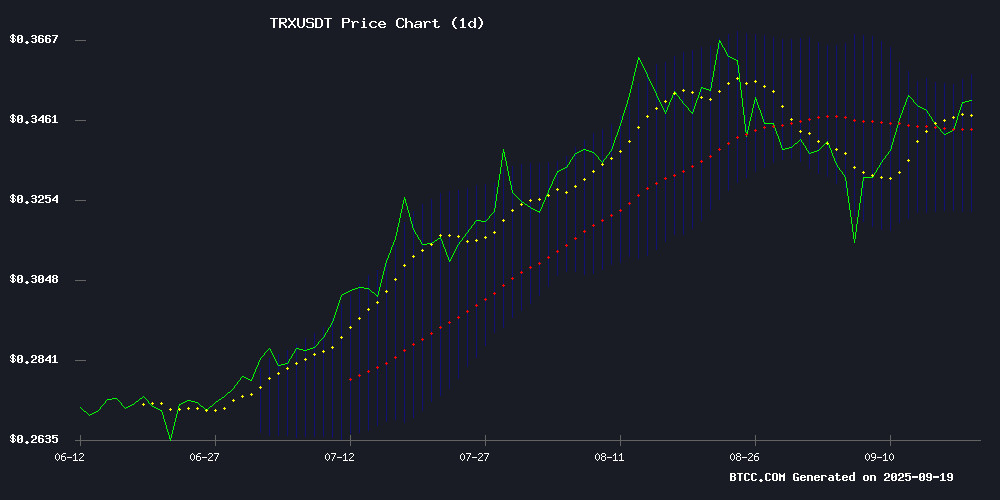

TRX is currently trading at $0.3454, positioned above its 20-day moving average of $0.3398, indicating near-term bullish momentum. The MACD reading of -0.002113 suggests some bearish pressure in the short term, though the signal line at 0.003200 shows underlying strength. Bollinger Bands analysis reveals price action NEAR the upper band at $0.3571, with support at $0.3226, suggesting potential for continued upward movement if momentum sustains.

According to BTCC financial analyst Sophia, 'The technical setup favors cautious optimism. Holding above the 20-day MA while approaching the upper Bollinger Band suggests buyers remain in control, though the negative MACD histogram warrants monitoring for any momentum shifts.'

Regulatory Developments and Market Sentiment Boost TRX Outlook

Recent regulatory developments involving US lawmakers questioning the SEC's handling of Justin Sun's case, combined with Tron's Nasdaq ambitions, are creating positive sentiment around TRX. The emerging 'altseason' signals across cryptocurrency markets further support potential upside for selected altcoins including TRX.

BTCC financial analyst Sophia notes, 'The regulatory clarity sought by lawmakers could remove significant overhangs for Tron, while Nasdaq listing ambitions signal growing institutional acceptance. These fundamental factors, coupled with technical strength, create a favorable environment for TRX investors.'

Factors Influencing TRX's Price

US Lawmakers Question SEC's Handling of Justin Sun Case and Tron's Nasdaq Ambitions

Senator Jeff Merkley and Representative Sean Casten have demanded clarity from the SEC regarding its dismissal of an enforcement case against Tron founder Justin Sun. The lawmakers' September 17 letter highlights concerns over Sun's business ties to former President Donald Trump, suggesting potential conflicts of interest during the TRUMP administration.

The SEC's 2023 lawsuit accused Sun of manipulating TRX's price to illicitly gain $31 million. With TRON exploring a Nasdaq listing, Merkley and Casten emphasize the need for rigorous oversight of Sun's access to US capital markets, citing national security and investor protection risks.

More Altseason Signals Are Flashing, Which Altcoin Will Peak Next?

Analyst Ito Shimotsuma highlighted a rare "death cross" in Bitcoin dominance, a pattern last seen in 2016 and 2021, which historically precedes parabolic gains for altcoins. Bitcoin's market share has dropped 12% since June, signaling potential altcoin momentum.

Hyperliquid (HYPE) and Binance Coin (BNB) reached record highs this week, while Ethereum and iFinex's LEO token hover within 8% and 6% of their peaks, respectively. XRP, Solana (SOL), and Tron (TRX) trail slightly further behind.

Is TRX a good investment?

Based on current technical indicators and market developments, TRX presents a compelling investment opportunity for risk-tolerant investors. The cryptocurrency is trading above its key 20-day moving average with strong support levels, while positive regulatory developments and institutional ambitions provide fundamental support.

| Metric | Current Value | Signal |

|---|---|---|

| Current Price | $0.3454 | Neutral |

| 20-Day MA | $0.3398 | Bullish |

| Bollinger Upper Band | $0.3571 | Resistance |

| Bollinger Lower Band | $0.3226 | Support |

| MACD Histogram | -0.005312 | Caution |

Investors should monitor the $0.3226 support level and watch for MACD convergence for optimal entry points.